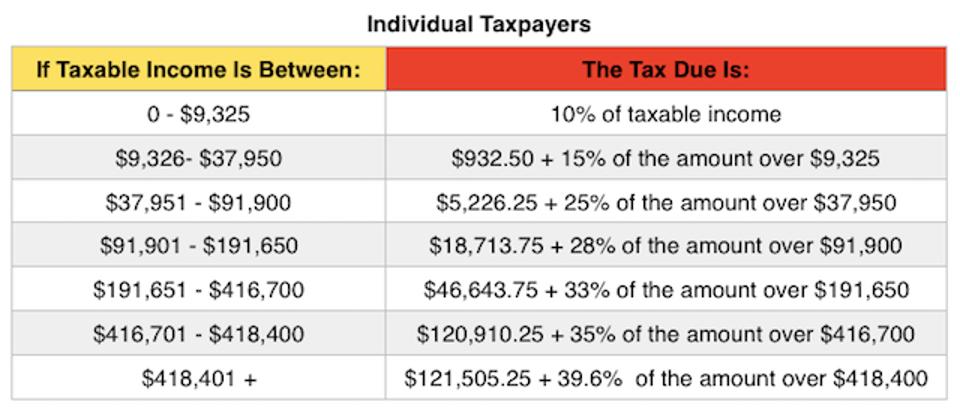

The higher limit may help some couples claim the full benefits of this tax credit, especially if one spouse has income above $200,000 and the other has no income and would not benefit from claiming the credit on their individual tax return. The child tax credit gets phased out at an AGI of $200,000, but that doubles to $400,000 for those who are married filing jointly. Tax CreditsĬertain types of tax credits and deductions such as the child tax credit can also play a role when deciding on filing taxes jointly. However, by filing jointly, more of the couple’s combined income can be offset by the larger standard deduction. In some cases, using the higher standard deduction could reduce your taxes.įor example, if one spouse works part-time and earns $10,000 per year, the standard deduction for those who are married filing separately would be more than their income, so they wouldn’t be able to take full advantage of the deduction. Standard Deductionsįor federal taxes, the 2022 standard deduction is $12,950 for those who are married filing separately, and it doubles to $25,900 for those who are married filing jointly. If you used the married filing separately status, however, and your individual AGI is $500,000 while your spouse did not earn income, that would mean some of your income would fall into the 11.3% bracket for single/married filing separately filers (on income between $406,365 and $677,275).

One advantage of filing taxes jointly in California can be that tax brackets have higher income ranges for both federal and state taxes, which can help some couples reduce their effective tax rate.įor example, for California state taxes, if your combined adjusted gross income (AGI) is $500,000, you would primarily fall into the 9.3% tax bracket (on income between $132,591 and $677,278). To decide which filing status works best for your family, consider factors such as the following: Income Tax Rates Keep in mind that although the decision to file separately may seem counterintuitive for those who intend to stay married and for those who share finances, there can be situations where the couple saves money by filing separately. Choosing your filing status can also include considerations such as tax deductions, for which sometimes there are advantages to filing jointly and sometimes there are advantages to filing separately. separately can depend on a number of factors, such as the income of each spouse and how that income affects the tax brackets they fall into. While filing taxes jointly in California can often help couples simplify their tax preparation and potentially save money, it’s not always a clear-cut decision.įiling taxes jointly vs. For married couples, tax season brings about an important family decision to make: filing taxes jointly vs.

0 kommentar(er)

0 kommentar(er)